Find out the latest Olé news

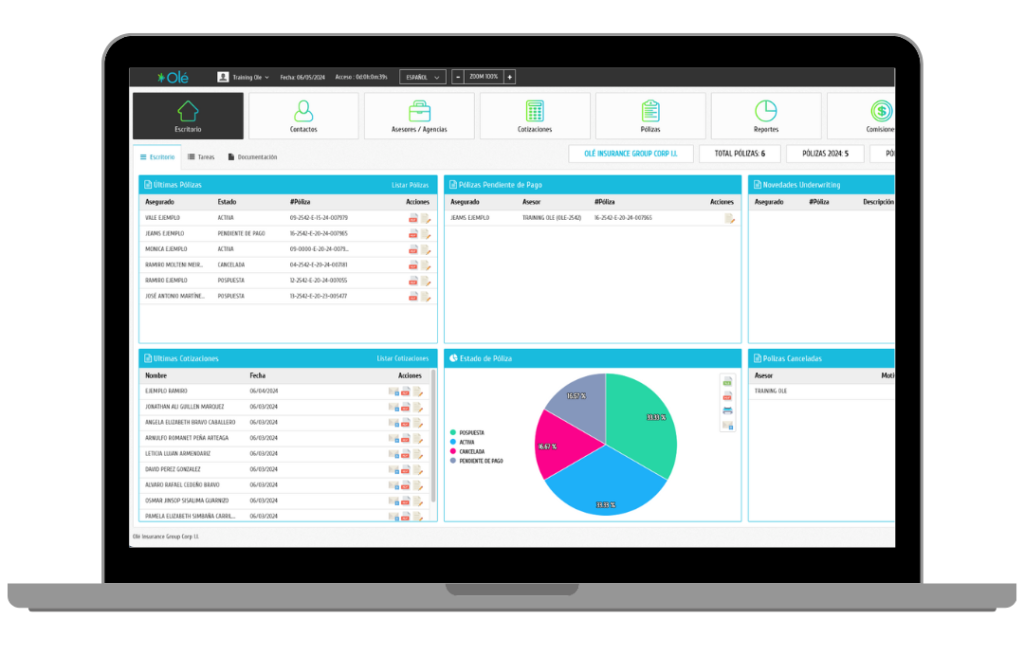

We want to make it easier for you to access the information you need to manage your portfolio more efficiently. Starting in June 2024, you will be able to enjoy the new functionality of information downloads and the new section for approved but not activated applications: Advisors/Agencies Section: Download information about your hierarchy, including contract status, number of sub-agents, commission level, and effective date. Available for advisor/agency users and operational users….

We aim to simplify your life, which is why the retention report we’ve specifically crafted for you is now accessible on the portal. With just one click, you can download all the necessary information in Excel…

Come and join us on an exciting adventure in Miami! We are delighted to invite you to visit our operational support offices in the vibrant city of Miami. Here, you will have the opportunity to immerse yourself in the heart of Olé and meet firsthand our dedicated team and Michael Carricarte…

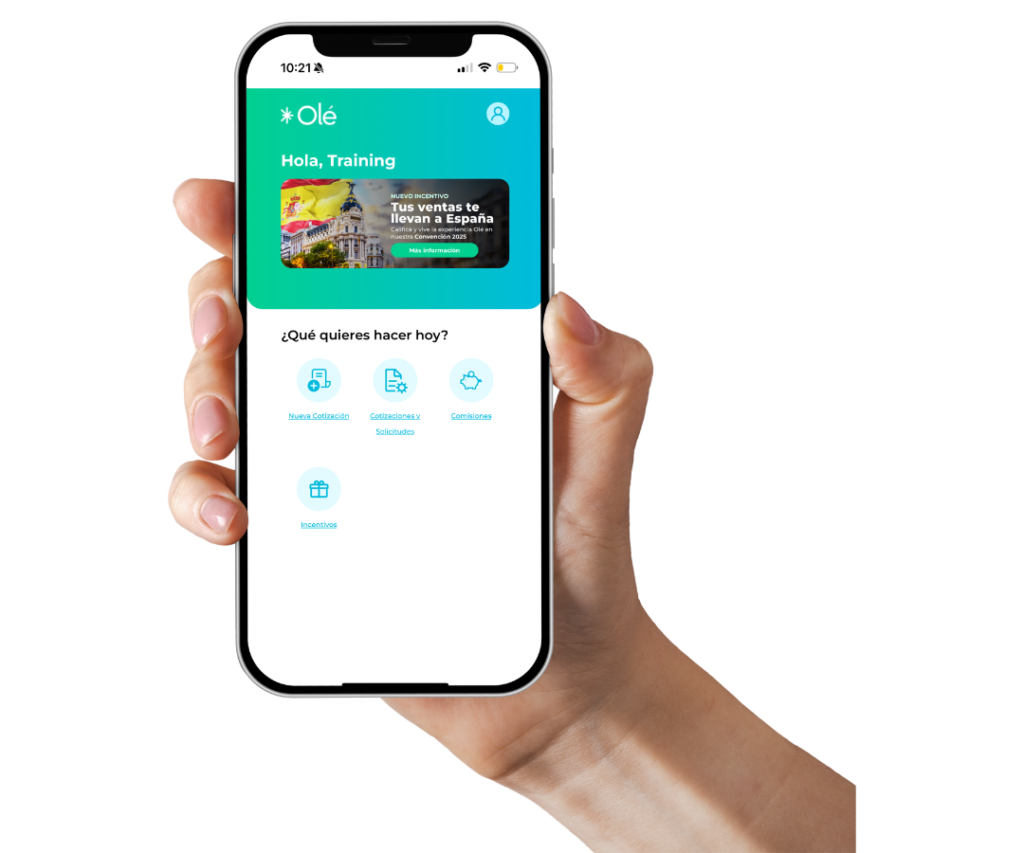

At Olé we want to enrich your life and turn it into an exciting adventure. Spain, with its cultural diversity, rich history and stunning landscapes, becomes the perfect backdrop for this unforgettable trip. Join us to our 2025 convention in a country full of magic, such as Spain…

We are thrilled to announce the relaunch of our much-anticipated life insurance plan – Master Term! After meticulous planning and dedication, we are excited to share the enhanced features that make Master Term stand out in the market….

At Olé Life, we are committed to staying at the forefront of innovation, ensuring that our services are not only efficient but also used to assess good risk. Therefore, as of December 1st, we are implementing a positive change to our tele-underwriting process…

Exciting news! We will be rolling out a brand-new initiative to keep you in the loop about your business like never before – introducing your Weekly Business Summary!What’s in Your Report: Business at Risk: Policies that will be lapsed or cancelled for non-payment in the next 15 days….

With 2 spectacular cities, you will have the opportunity to participate in an unforgettable trip with Olé. Whether it be Cartagena, Colombia, where historic charm meets vibrant culture with delicious local cuisine or enjoying Miami’s breathtaking beaches along with VIP experience…

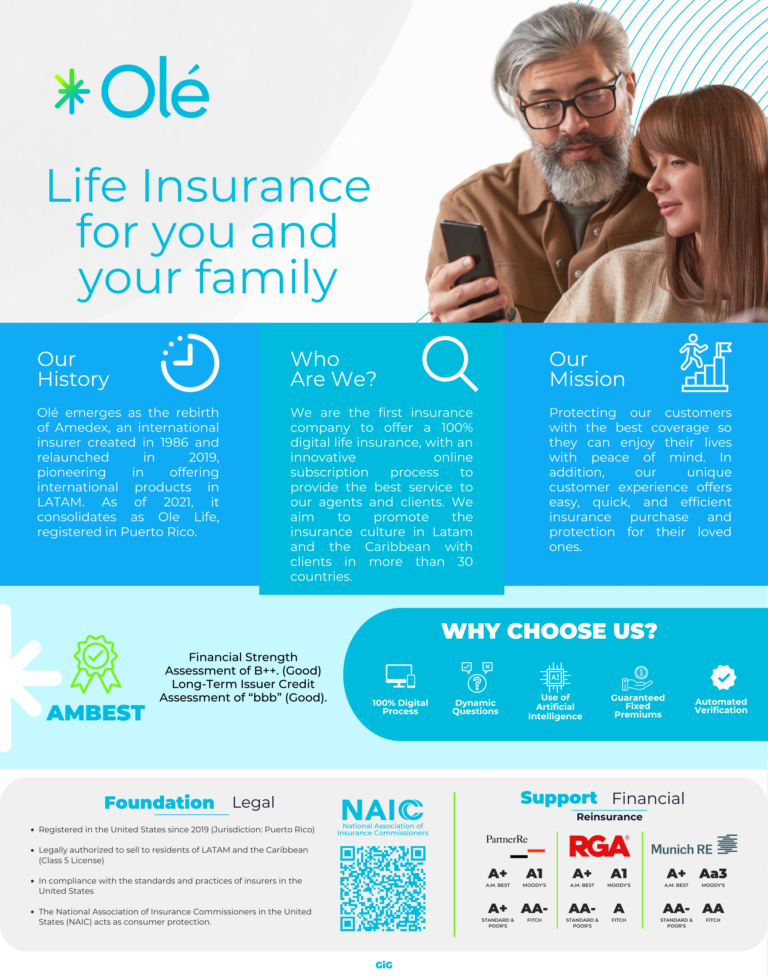

After months of hard work, “AM Best has assigned a Preliminary Credit Assessment (PCA)* to Olé Insurance Group Corp. I.I. (San Juan, Puerto Rico) with a Financial Strength Assessment of B++. pca (Good) and a Long-Term Issuer Credit Assessment of BBB. pca (Good). The outlook assigned to this PCA is stable. ” Source: AM Best…

We are pleased to announce that Munich Re has joined our family of reinsurers, along with Partner Re and RGA. This partnership strengthens our commitment, support, and seriousness in the business. Munich Re, the world’s largest reinsurer, becomes our commercial partner in a 90% reinsurance arrangement, with a risk-sharing reinsurance contract…

At Olé, we are committed to providing our clients with the best possible experience throughout their insurance journey. As part of our ongoing efforts to enhance security and streamline our processes, we have implemented a new verification process. Starting November 1st, when clients initiate a new…

Starting November 1st, we are implementing an improvement to our commission payment process, specifically related to ACH transactions. This enhancement is designed to streamline operations and provide an even more seamless experience for you. The key update is that, moving forward, all commission payments made through ACH will…

At Olé, we celebrate our business partners and top agents in style! On this special occasion, we welcomed more than 120 advisors from 30 different countries in Greece from September 28th to October 2nd. We explored the rich history, culture and cuisine of Athens and Crete, and celebrated our…

As part of our strategy to remain competitive and profitable, we have made our first-rate update after 20 months of operation. This 2% adjustment is due to the increase in banking rates impacting the surcharge for semi-annual, quarterly, and monthly payment mode in policies. We have also…

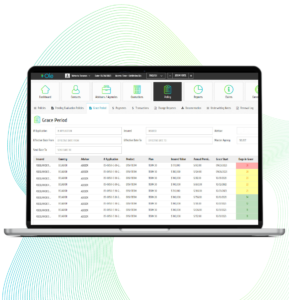

We would like to announce a significant enhancement to the advisor portal that will empower you with a clearer understanding of policies currently in their grace period. Our goal is to provide you with valuable tools to better manage and support your clients. In the advisor portal, under the Policy section, we have added a dedicated tab offering a comprehensive view of all policies currently in…